54+ what happens if a spouse dies with a reverse mortgage

Compare a Reverse Mortgage with Traditional Home Equity Loans. Web The spouse must obtain title to the home and continue to reside there.

How Reverse Mortgages Affect Heirs Inheritance Reversemortgagereviews Org

Read In-Depth Reviews and Compare 2023s Top Reverse Mortgage.

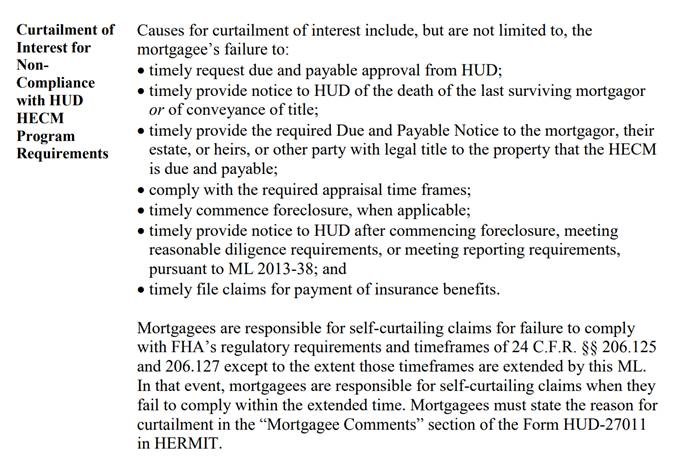

. Web If your heirs want to keep your home after you and your spouse die they will have to repay either the full loan balance or 95 percent of the homes appraised value. Web If you die with a will or trust in place the legal documents youve set up outline who you want to inherit your estate or parts of your estate after youre. The lender may foreclose.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Ad Find Pros And Cons Of Reverse Mortgage. All property charges taxes and insurance must be kept current.

And the property must be adequately. Compare Top Lenders and Learn Pros Cons. Review 2023s Best Reverse Mortgage Lenders.

Trusted By Over 45000000. Skip The Bank Save. Ad Use Our Comparison Site Find Out Which Lender Suits You Best.

Web When you and your spouse are co-borrowers on a reverse mortgage neither of you have to pay back the mortgage until you both move out or both die. Connect with a reverse mortgage lender now to see if you qualify with a free consultation. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Dont wait Find now Pros And Cons Of Reverse Mortgage. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

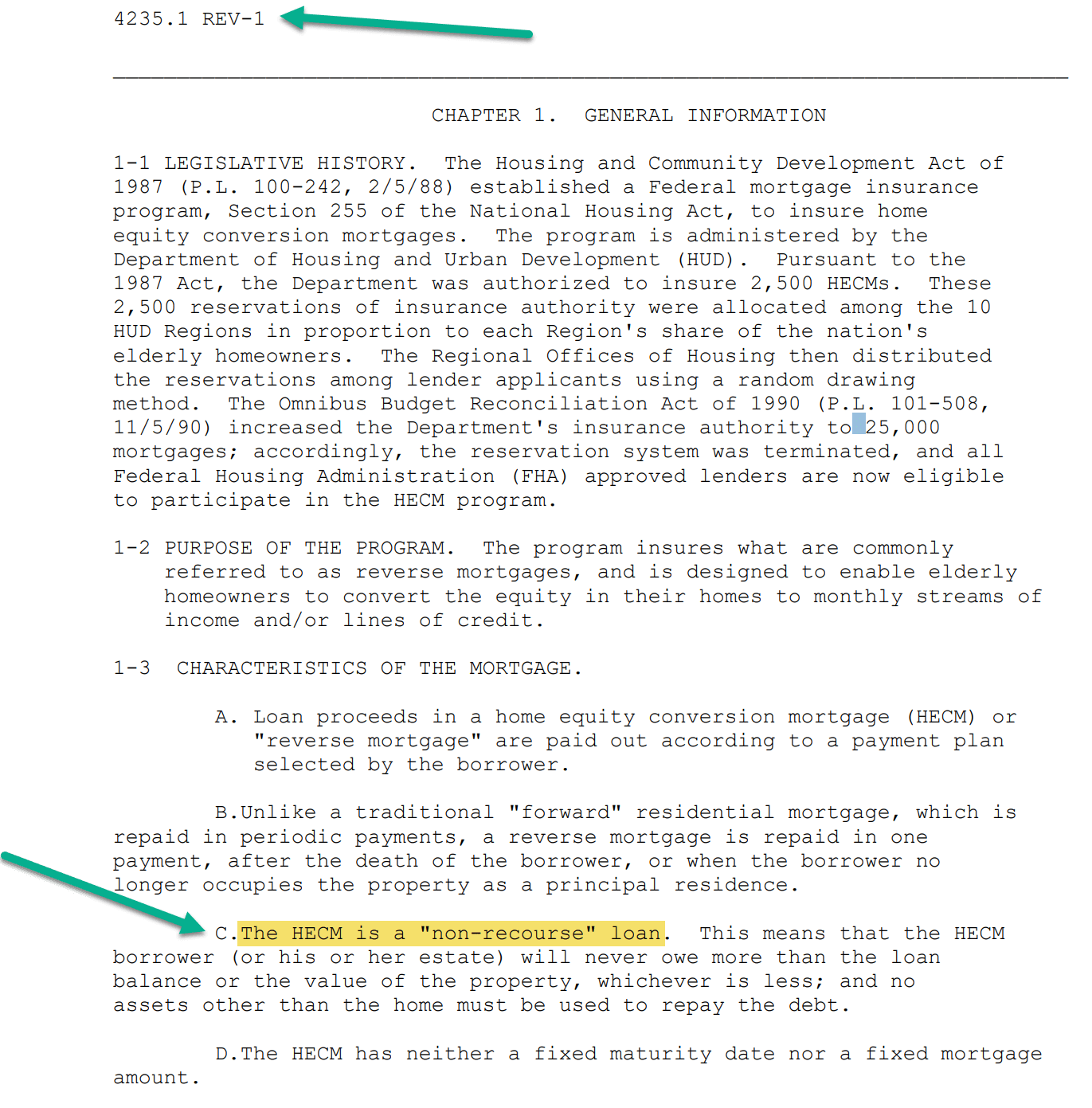

Web If the reverse mortgage was closed before August 4 2014 and the borrowing spouse leaves the residence these rules apply. Web An Eligible Non-Borrowing Spouse is a term used for your spouse when they are not a co-borrower but qualify under the US. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Department of Housing and Urban. The couple jointly owns the home and completed the reverse mortgage.

Web With most married couples a reverse mortgage after death is fairly straightforward.

Reverse Mortgage Spouse Q A Series Just Ask Arlo

Retirement Can Be A Risky Business By Yourlifechoices Issuu

Electronic Media Management Ayo Menulis Fisip Uajy

:max_bytes(150000):strip_icc()/GettyImages-1151623803-9f1019b0ea2047479c5611294a5ec381.jpg)

Options When A Spouse Dies With A Reverse Mortgage

What Rights Do The Family Of A Reverse Mortgage Borrower Have When The Borrower Dies Bay Area Legal Services

What Happens With A Reverse Mortgage When The Owner Dies Propertyclub

The Jobs Report In Light Of What Powell Said The Fed Cannot Create Supply Of Labor But It Can Slow The Demand For Labor Wolf Street

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1905 Session I Public Health Statement By The Minister Of Public

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

:max_bytes(150000):strip_icc()/EchoShowBlackFamilyCalling-5ba53d9bc9e77c0050474beb.jpg)

Reverse Mortgage Problems For Heirs

Reverse Mortgage Alternatives 5 Options For Seniors Credible

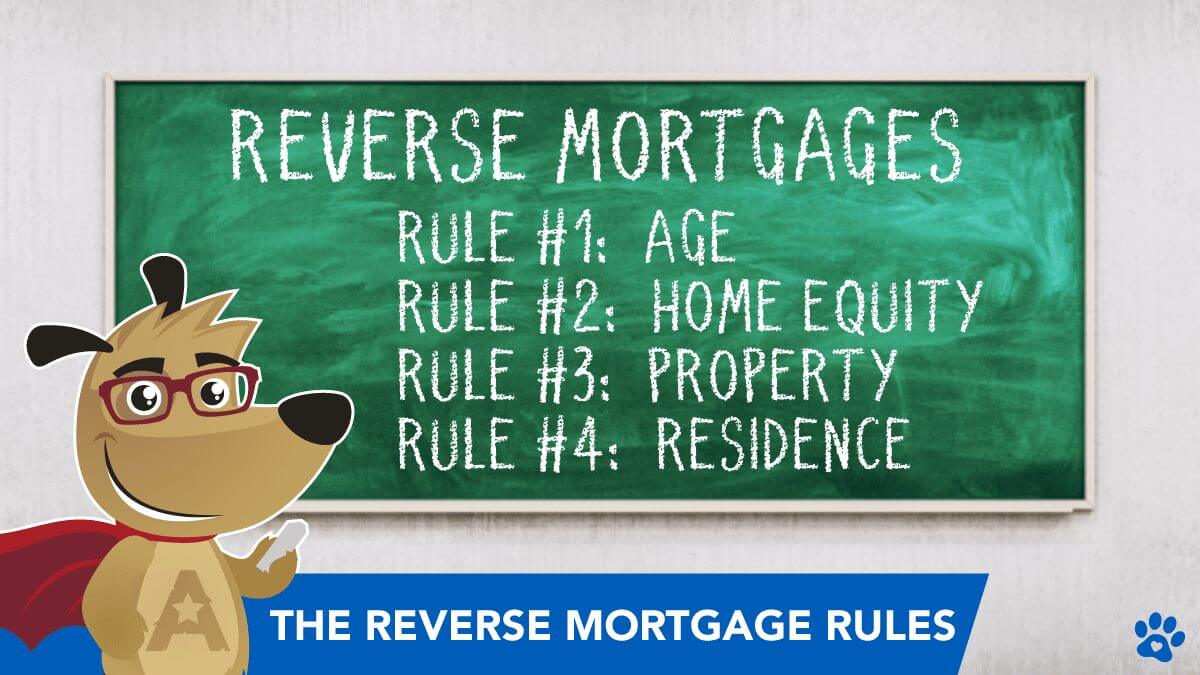

5 Rules That Apply To Reverse Mortgages In 2023

Reverse Mortgage After Death Responsibility Of Heirs More

Reverse Mortgage After Death What Heirs Family Must Know

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend